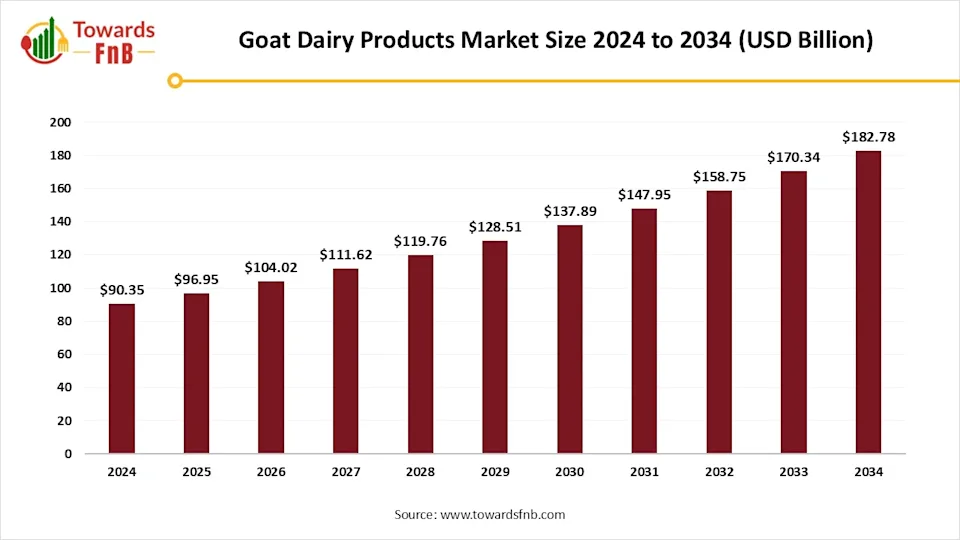

Goat Dairy Products Market Set to Reach USD 182.78 Billion by 2034

The global goat dairy products market is entering a strong growth phase, projected to expand from USD 96.95 billion in 2025 to USD 182.78 billion by 2034, registering a CAGR of 7.3%, according to Towards FnB. The surge reflects a decisive shift toward nutritional, premium, and digestibility-focused dairy options worldwide.

Why Goat Dairy Is Winning

Goat milk is no longer a niche alternative—it’s becoming a strategic category. Key growth drivers include:

- Rising lactose intolerance and gut health concerns

- Preference for easily digestible, low-allergen dairy

- Demand for clean-label, organic, and sustainable foods

- Growing acceptance of goat milk–based infant nutrition

Consumers are choosing goat dairy not out of novelty, but necessity—and increasingly, aspiration.

Regional & Segment Snapshot

Geography

- Asia-Pacific led the market with 42% share in 2024, driven by population growth, traditional acceptance, and health awareness

- North America is the fastest-growing market, fueled by premiumization and infant formula demand

- Europe continues steady growth, particularly in specialty cheeses and organic dairy

By Product

- Fluid goat milk dominated with 38.6% share (2024)

- Goat milk powder is set for rapid growth due to infant nutrition and long shelf life

By Channel

- Hypermarkets & supermarkets: 38.5% revenue share

- E-commerce: fastest-growing channel, riding convenience and premium discovery

By End Use

- Adult/general consumers: 43.5% share

- Infant nutrition: steady and strategic growth segment

Beyond Food: Multi-Industry Demand

Goat dairy’s appeal now spans multiple sectors:

Food & Nutrition

- Cheese, yogurt, butter, kefir, ice cream

- Strong traction in infant formula and sports nutrition

Cosmetics & Dermatology

- Goat milk soaps, creams, lotions

- Valued for lactic acid, skin barrier repair, and eczema relief

Pharma & Functional Nutrition

- Bioactive peptides, oligosaccharides

- Antioxidant, antimicrobial, and gut-health applications

Goat Dairy Products Market

| Product Category | Description / Function | Common Forms / Variants | Key Applications / Consumer Segments | Representative Producers / Brands |

|---|---|---|---|---|

| Fresh Goat Milk | Fluid milk with smaller fat globules; easier digestion | Whole, low-fat, organic | Household consumption, cafés, pediatric use (where tolerated) | Meyenberg, Summerhill Goat Milk, Woolwich Dairy |

| Goat Milk Powder | Spray-dried milk for long shelf life | Whole powder, skim powder, infant-grade powder | Infant nutrition, baking, recombined milk | Dairy Goat Cooperative NZ, AusGoat |

| Goat Cheese (Chèvre) | Soft, tangy fresh cheese | Chèvre logs, flavored chèvre, whipped chèvre | Salads, spreads, gourmet foodservice | LaClare Creamery, Vermont Creamery |

| Aged Goat Cheese | Hard/semi-hard cheeses with developed flavor | Aged chèvre, Gouda-style, Cheddar-style | Cheeseboards, specialty retail, fine dining | Cypress Grove, Belle Chevre |

| Goat Yogurt | Fermented product with mild tartness | Plain, flavored, Greek-style | Breakfast foods, digestive health consumers | Redwood Hill Farm, Delamere Dairy |

| Goat Kefir | Probiotic fermented beverage | Plain, fruit-flavored | Gut-health focused consumers | Redwood Hill Farm Kefir, artisanal brands |

| Goat Butter | Butter from goat cream; white color, mild tang | Salted, unsalted, organic | Baking, spreading, premium dairy segment | Meyenberg, European artisanal producers |

| Goat Cream & Half-and-Half | Cream fraction for culinary use | Heavy cream, light cream, half-and-half | Sauces, coffee, specialty food manufacturing | Regional goat creameries |

| Goat Ice Cream & Frozen Desserts | Frozen desserts for lactose-sensitive consumers | Plain, cardamom, chocolate | Premium retail, gourmet dessert markets | Laloo’s Goat Milk Ice Cream |

| Goat Milk-Based Infant Formula | Infant nutrition using goat milk proteins | Goat whey formula, lactose-adjusted formula | Infant nutrition (0–12 months) | Kendamil Goat, Bubs Goat Formula |

| Ultra-Filtered / High-Protein Goat Milk | Protein-concentrated milk via filtration | High-protein drinks, concentrates | Sports nutrition, medical diets | Niche dairy processors |

| Goat Milk Nutraceutical Ingredients | Bioactive functional ingredients | Colostrum powder, whey proteins | Supplements, functional foods | Colostrum suppliers, whey processors |

| Goat Milk Soap & Cosmetics | Topical products for skin care | Soap bars, lotions, creams | Sensitive skin users, natural cosmetics | Bend Soap Company, Dionis |

| Goat Ghee | Clarified goat butter | Traditional, organic | Culinary use, Ayurvedic & wellness markets | Regional artisanal producers |

What’s New in 2025

- Soignon (France) launched Triple Cream Goat Brie for the US premium cheese market

- Kabrita introduced the first goat milk infant formula approved by Health Canada—a regulatory milestone

Read More: Telangana Dairy Cooperative to Raise Milk Procurement to 6 Lakh Litres per Day

Regulatory, Quality and Market-Access Considerations for Goat Dairy Products

1. Infant Formula Regulation

Goat-milk–based infant formula is regulated at par with cow-milk formula in most jurisdictions. This means:

- Pre-market approval is mandatory before sale

- Strict compositional standards (protein quality, fat profile, micronutrients)

- Detailed labelling requirements, including allergen declarations and age suitability

- Product registration and dossier submission are required for exports in many countries

Failure to comply results in outright market rejection. In short: no shortcuts, no sympathy from regulators.

Before domestic sale or export, goat dairy products must clear comprehensive food-safety checks, including:

- Microbiological standards (pathogens, total plate count, yeast & mould)

- Chemical contaminant limits

- Antibiotic residue testing

- Shelf-life validation and stability studies

Most importing countries demand a Certificate of Analysis (CoA) from an accredited laboratory with every shipment. Quality is not a promise—it’s paperwork.

Customs classification presents a subtle but serious challenge:

- Many HS codes do not clearly differentiate milk by animal species

- Importers may require explicit species declaration (goat vs cow vs buffalo)

- Misclassification can lead to customs delays, reclassification penalties, or rejection

Exporters must verify country-specific HS lines and documentation requirements before shipment, not after containers are stuck at port.

Certain goat cheeses carry Protected Designation of Origin (PDO) or GI status, particularly in Europe.

- These protections restrict product naming and labeling

- Non-origin producers cannot legally use protected names

- Misuse can result in trade disputes or forced relabeling

For exporters, this means smart branding is as important as product quality.

Goat dairy is a high-growth, high-value sector, but it is also high-regulation, high-scrutiny. Success depends on:

- Regulatory foresight

- Robust quality systems

- Export documentation discipline

- Intelligent market positioning

In goat dairy, the product may be artisanal—but the compliance must be industrial-grade.

Market Reality Check

Challenges

- Higher production costs (more goats needed per litre vs cows)

- Shorter shelf life

- Limited cold-chain and distributor reach

- Hygiene and nutrition management at scale

Opportunities

- Functional, organic, and fortified products

- Infant and clinical nutrition

- Ultra-filtered, high-protein goat milk

- Premium cheese and frozen desserts

Bottom Line

Goat dairy is transitioning from alternative to strategic mainstream. The growth is not hype-driven—it’s anchored in health science, nutrition needs, and premium consumer behavior. For processors, cooperatives, and entrepreneurs, this is a category where value addition beats volume, and trust beats price wars.

Credit : www.agrimoon.com